| |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

OLD DOMINION FREIGHT LINE, INC.

500 Old Dominion Way

Thomasville, North Carolina 27360

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

The Annual Meeting of Shareholders of Old Dominion Freight Line, Inc. will be held Wednesday, May 18, 2022,15, 2024, at 10:00 a.m. Eastern Daylight Time, at our principal executive offices, 500 Old Dominion Way, Thomasville,the Grandover Resort, 1000 Club Road, Greensboro, North Carolina 27360,27407, for the following purposes:

|

|

|

|

|

|

|

|

Shareholders of record at the close of business on March 10, 2022,7, 2024, are entitled to notice of and to vote at the meeting.

By Order of the Board of Directors

Ross H. Parr

Senior Vice President - Legal Affairs,

General Counsel and Secretary

Thomasville, North Carolina

April 18, 202215, 2024

If you do not intend to be present at the meeting, we ask that you vote your shares using a toll-free telephone number, the Internet, or by signing, dating and returning the accompanying proxy card or voting instruction form promptly so that your shares of common stock may be represented and voted at the Annual Meeting. Instructions regarding the different voting options that we providemade available to you are contained in the accompanying proxy statement.

TABLE OF CONTENTS TO THE PROXY STATEMENT

1 | ||

7 | ||

Security Ownership of Management and Certain Beneficial Owners | 9 | |

11 | ||

| ||

14 | ||

14 | ||

15 | ||

15 | ||

17 | ||

17 | ||

| ||

18 | ||

21 | ||

22 | ||

| ||

| ||

| ||

Securities Trading Policy |

| |

25 | ||

25 | ||

| ||

| ||

| ||

| ||

Role of Compensation Committee, Independent Directors and Management |

| |

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

|

OLD DOMINION FREIGHT LINE, INC.

Principal Executive Offices: 500 Old Dominion Way

Thomasville, North Carolina 27360

___________________

PROXY STATEMENT

___________________

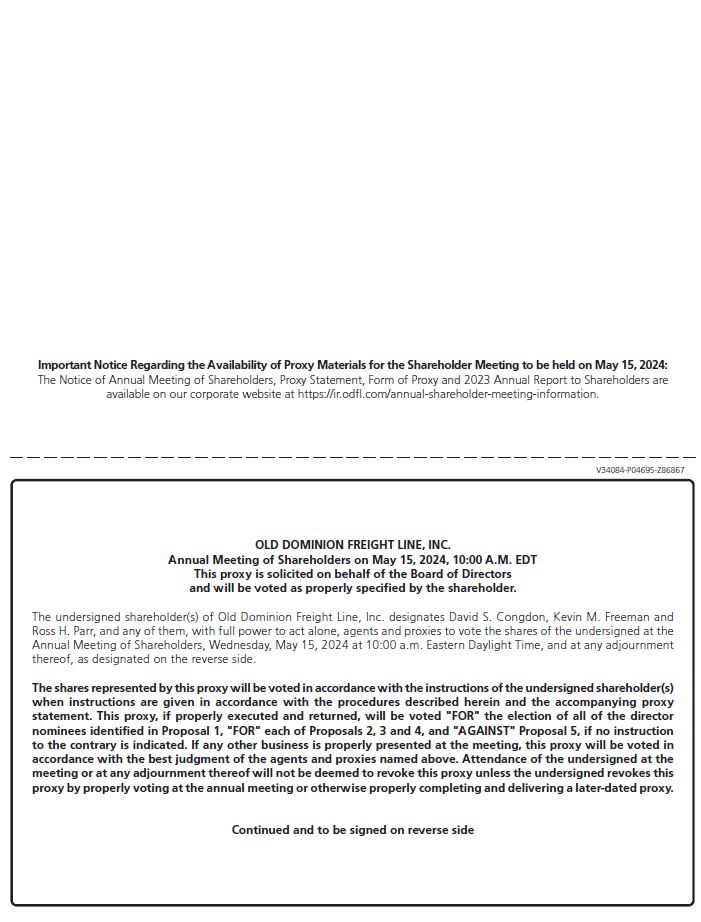

Important Notice Regarding the Availability of Proxy Materials

for the Shareholder Meeting to be held on May 18, 2022:15, 2024:

The Notice of Annual Meeting of Shareholders, Proxy Statement, Form of Proxy and 20212023 Annual Report to Shareholders are available on our corporate website at https://ir.odfl.com/annual-shareholder-meeting-information.

This proxy statement is first being sentdistributed to shareholders on or about April 18, 2022,15, 2024, in connection with the solicitation of proxies by and on behalf of the Board of Directors (the “Board”) of Old Dominion Freight Line, Inc. for use at the Annual Meeting of Shareholders to be held at our principal executive offices, 500 Old Dominion Way, Thomasville,the Grandover Resort, 1000 Club Road, Greensboro, North Carolina 2736027407 on Wednesday, May 18, 2022,15, 2024, at 10:00 a.m. Eastern Daylight Time, and at any adjournment thereof. If you need directions so you can attend the Annual Meeting and vote in person, please contact our Corporate Secretary at (336) 889-5000.

On February 16, 2024, we announced that our Board approved a two-for-one stock split of the Company’s outstanding shares of common stock, and our common stock began trading on a split-adjusted basis on March 28, 2024 (the “two-for-one stock split”). All share and per-share information presented in this proxy statement has been adjusted to reflect the two-for-one stock split, unless otherwise indicated.

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting. | ||

Annual Meeting of Shareholders | ||

• Time and Date | 10:00 a.m., Wednesday, May | |

• Place |

| |

| ||

| ||

• Record Date | March | |

• Voting | Shareholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the proposals to be voted on at the meeting. | |

• Admission | If you decide to attend the meeting in person, upon your arrival you will need to register with our | |

-1-

-1-

Meeting Agenda/Proposals | ||||

Board Vote | Page Reference | |||

• Election of | FOR ALL | 11 | ||

• Approval, on an advisory basis, of | FOR | 61 | ||

• Approval of an Amendment to our Amended and Restated Articles of Incorporation to increase the number of authorized shares of our common stock | FOR | 63 | ||

• Ratification of Ernst & Young LLP | FOR |

| ||

• A shareholder proposal regarding greenhouse gas reduction targets | AGAINST | 65 | ||

Transact other business, if any, that | ||||

Election of Directors Our directors are elected annually for one-year

| ||||

-2-

Election of Directors (continued) | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| Committees | |||||||||

Name |

| Age |

| Director |

| Occupation |

| Independent |

| AC |

| CC |

| GNC | |||||||

David S. Congdon |

| 65 |

| 1998 |

| Executive Chairman of the Board of Directors, Old Dominion |

|

|

|

|

|

|

|

| |||||||

Sherry A. Aaholm |

| 59 |

| 2018 |

| Vice President and Chief Digital Officer, Cummins, Inc. |

| X |

| X |

|

|

| X | |||||||

John R. Congdon, Jr. |

| 65 |

| 1998 |

| Private investor |

|

|

|

|

|

|

|

| |||||||

Bradley R. Gabosch |

| 70 |

| 2016 |

| Private investor |

| X |

| X |

|

|

| X | |||||||

Greg C. Gantt |

| 66 |

| 2018 |

| President and Chief Executive Officer, Old Dominion |

|

|

|

|

|

|

|

| |||||||

Patrick D. Hanley |

| 77 |

| 2016 |

| Private investor |

| X |

| X |

| X |

|

| |||||||

John D. Kasarda, Ph.D. |

| 76 |

| 2008 |

| CEO and President of Aerotropolis Business Concepts LLC; President of Aerotropolis Institute China; Faculty, University of North Carolina at Chapel Hill's Kenan-Flagler Business School |

| X |

|

|

|

|

| C | |||||||

Wendy T. Stallings |

| 47 |

| 2020 |

| Owner and President, TPI Event Solutions, Inc.; Real estate investor |

| X |

|

|

| X |

|

| |||||||

Thomas A. Stith, III |

| 58 |

| 2021 |

| President, North Carolina Community College System |

| X |

|

|

|

|

| X | |||||||

Leo H. Suggs |

| 82 |

| 2009 |

| Private investor |

| X |

|

|

| C |

| X | |||||||

D. Michael Wray

|

| 61

|

| 2008 |

| President, Riverside Brick & Supply Company, Inc. |

| X |

| C |

| X |

|

| |||||||

AC - Audit Committee

CC - Compensation Committee | GNC - Governance and Nomination Committee

C - Committee Chair

| ||||||||||||||||||||

Approval, on an Advisory Basis, of the Compensation of our Named Executive Officers | |||||||||||||||||||||

We are asking our shareholders to approve, on a non-binding, advisory basis, the compensation of our named executive officers. The Board believes that our executive compensation policies are designed appropriately and are functioning as intended to align pay with performance and produce long-term value for our shareholders.

| |||||||||||||||||||||

-3-

|

| ||||||||||||||||

|

| ||||||||||||||||

-2-

Election of Directors (continued)

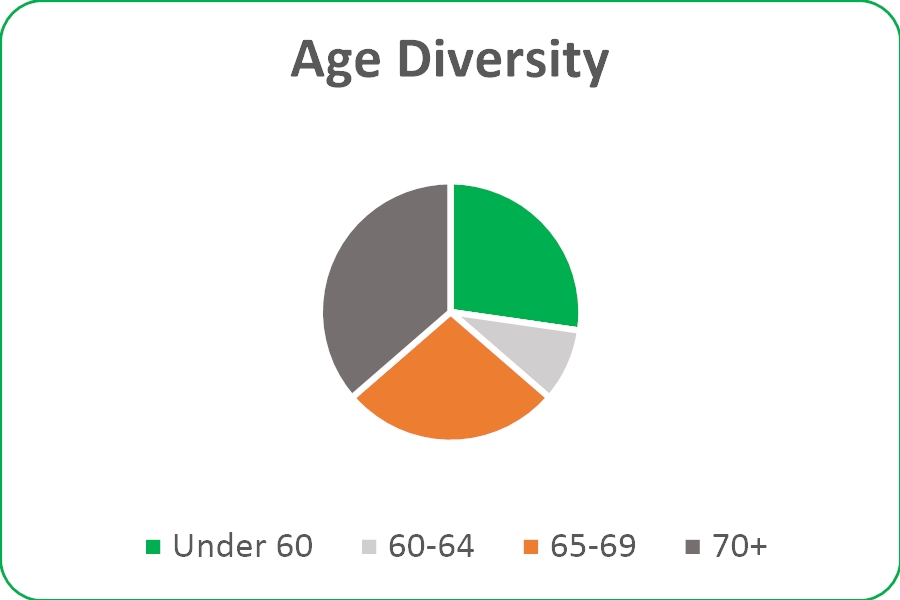

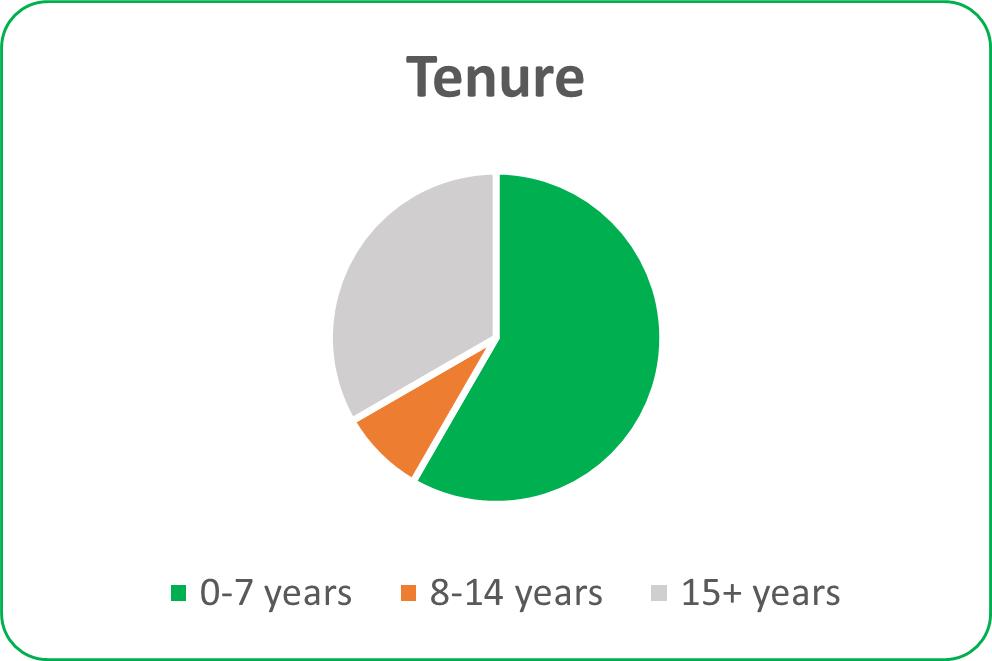

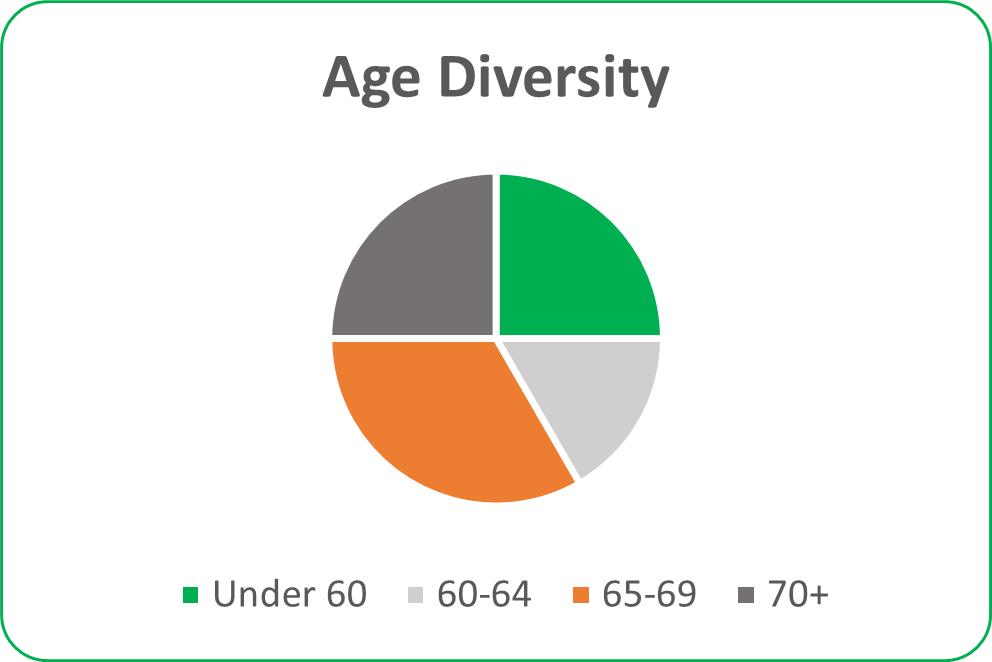

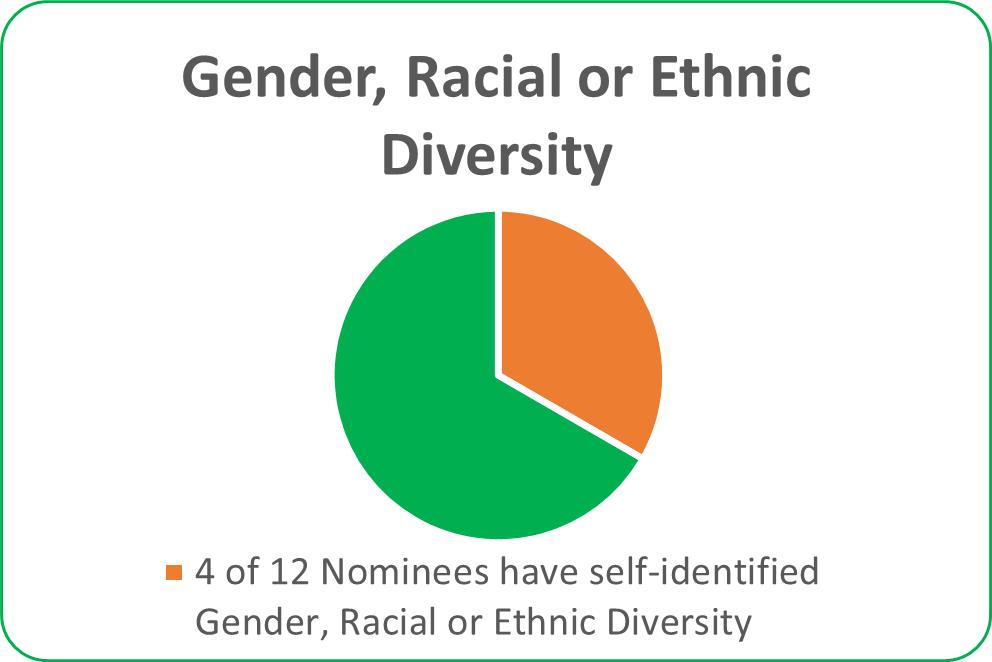

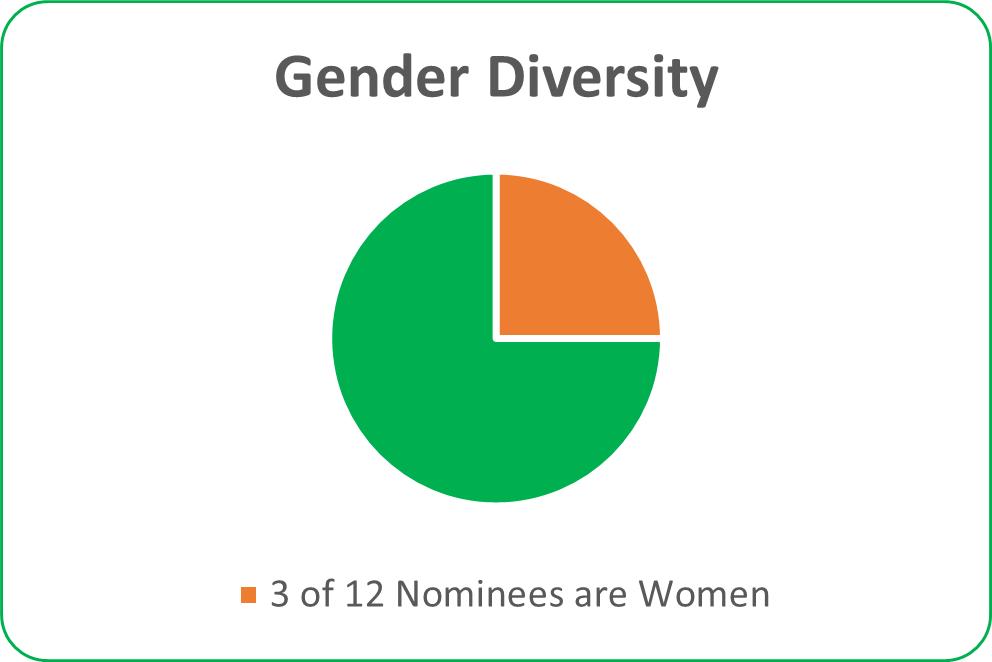

• 8 of our 12 director nominees are independent • Our director nominees have an average tenure of 9 years • 33% of our director nominees have self-identified gender, racial or ethnic diversity | |||||||||||||||||||

Committees | |||||||||||||||||||

Name |

Age | Director |

Occupation |

Independent |

AC |

CC |

GNC |

|

RC | ||||||||||

David S. Congdon | 67 | 1998 | Executive Chairman of the Board of Directors, Old Dominion

|

|

| ||||||||||||||

Sherry A. Aaholm | 61 | 2018 | Vice President and Chief Digital Officer, Cummins, Inc.

| X | C |

|

| X | |||||||||||

John R. Congdon, Jr.

| 67 | 1998 | Private investor |

|

| ||||||||||||||

Andrew S. Davis

|

| 46 |

| 2023 |

| Senior Vice President, Strategy and Investments, Cox Enterprises Inc. |

| X |

| X |

|

|

|

|

| X | |||

Kevin M. Freeman

|

| 65 |

|

|

| President and Chief Executive Officer, Old Dominion |

|

|

|

|

|

|

|

|

|

| |||

Bradley R. Gabosch

| 72 | 2016 | Private investor | X | X | X |

|

| |||||||||||

Greg C. Gantt

| 68 | 2018 | Private investor |

|

| ||||||||||||||

John D. Kasarda, Ph.D. | 78 | 2008 | CEO and President of Aerotropolis Business Concepts LLC; President of Aerotropolis Institute China; Faculty, University of North Carolina at Chapel Hill's Kenan-Flagler Business School | X | X | C |

|

| |||||||||||

Cheryl S. Miller

|

| 51 |

|

|

| Private investor |

| X |

|

|

|

|

|

|

|

| |||

Wendy T. Stallings

| 49 | 2020 | Owner, President and CEO, TPI Event Solutions, Inc.; Real estate investor | X | X |

|

| C | |||||||||||

Thomas A. Stith, III

| 60 | 2021 | Co-Founder and CEO, The Michael Thomas Group; Professor of the Practice, University of North Carolina at Chapel Hill's Kenan-Flagler Business School; Senior Fellow, Kenan Institute for Private Enterprise

| X | X |

| X | ||||||||||||

Leo H. Suggs *

| 84 | 2009 | Private investor | X | C | X |

|

| |||||||||||

AC - Audit Committee CC - Compensation Committee

* - Lead Independent Director

| GNC - Governance and Nomination Committee

RC - Risk Committee C - Committee Chair | ||||||||||||||||||

-3-

Approval, on an Advisory Basis, of the Compensation of our Named Executive Officers We are asking our shareholders to approve, on a non-binding, advisory basis, the compensation of our named executive officers. The Board believes that our executive compensation policies are designed appropriately and are functioning as intended to align pay with performance and produce long-term value for our shareholders. | ||||||||||

Fiscal | ||||||||||

Type | Form | General Purpose and Terms | ||||||||

Cash | Base Salary | Retention component that is reviewed annually and adjusted as needed, and executives are generally eligible for an annual increase. | ||||||||

Non-Equity | Motivates and rewards performance by linking a significant portion of compensation to profitability. Earned monthly based upon a fixed percentage, or participation factor, of our pre-tax income. No payment unless pre-tax income exceeds a required minimum performance threshold, and the aggregate PIP payments for each executive are limited to 10x the executive’s annual base salary. | |||||||||

Equity- based | Performance-Based Restricted | Aligns executive compensation with Company performance and shareholder value. Grants are awarded based on the Company’s operating ratio (a measure of profitability calculated by dividing total operating expenses by revenue). Any shares earned generally vest in increments of 33% per year on the anniversary of the grant date, subject to continued service requirements. | ||||||||

Performance-Based Restricted | Ties executive compensation to Company achievement of pre-tax income growth performance targets over a one-year performance period, with one-third of the award vesting following the conclusion of the performance period (to the extent the performance target is met) and an additional one-third of the award vesting on each anniversary thereafter, subject to continued service requirements. | |||||||||

Other | 401(k) Plan | Retirement plan with Company match; executive officers receive the same benefit as all employees. | ||||||||

Nonqualified | Self-funded retirement benefit; participants can defer significant percentages of annual base salary and monthly non-equity performance-based incentive compensation. No Company match or other contributions are provided by us. | |||||||||

The principal factors in the Compensation Committee’s executive compensation decisions for

| ||||||||||

-4-

Recent Compensation Decisions (continued)

$628,074 and an increase in his participation factor in the PIP to 0.30%, consistent with target pay opportunities for our other EVP-level role and reflecting Mr. Satterfield’s significant responsibilities.

In June 2023, in connection with Mr. Gantt’s retirement from the Company as an employee and in recognition of his distinguished contributions over his 28 years of service to the Company, and consistent with its authority under the Old Dominion Freight Line, Inc. 2016 Stock Incentive Plan (the “2016 Plan”), the Board accelerated the vesting of an aggregate of 24,898 shares, as adjusted for the two-for-one stock split, of the Company’s common stock subject to Mr. Gantt’s (i) outstanding unvested RSAs, and (ii) outstanding earned and unvested PBRSUs. During Mr. Gantt’s tenure as CEO, our annualized total shareholder return was approximately 30.5%. Mr. Gantt helped guide our Company through the COVID-19 pandemic and an orderly leadership transition and will continue to provide valuable contributions as a member of the Board. Vesting acceleration only occurred for outstanding equity awards where performance hurdles had already been achieved; Mr. Gantt forfeited his PBRSU that was granted in February 2023 since his retirement occurred prior to the completion of the performance cycle.

We believe these compensation program changes further enhance the pay-for-performance focus of our executive compensation program and continue to strengthen the alignment of our executive compensation program with the long-term interests of our shareholders.

| ||||||||||||

Fiscal 2023 Compensation Summary | ||||||||||||

The following table summarizes the compensation of our Chief Executive Officer, our Chief Financial Officer, our former Chief Executive Officer and our next three most highly compensated executive officers who were serving at December 31, 2023, to whom we refer to collectively as our named executive officers, for the fiscal year ended December 31, 2023. | ||||||||||||

Name |

Salary ($) (1) |

Stock Awards ($) |

Non-Equity Incentive Plan Compensation ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) |

All Other Compensation ($) |

Total Compensation ($) | ||||||

Kevin M. Freeman President and Chief Executive Officer | 784,387 | 1,113,075 | 7,558,433 | 2,390 | 38,326 | 9,496,611 | ||||||

Gregory B. Plemmons Executive Vice President and Chief Operating Officer | 568,682 | 762,767 | 4,012,039 | 809 | 31,877 | 5,376,174 | ||||||

Adam N. Satterfield Executive Vice President, Chief Financial Officer and Assistant Secretary | 576,909 | 941,023 | 4,555,292 | — | 46,023 | 6,119,247 | ||||||

-5-

-4-

Fiscal 2023 Compensation Summary (continued) | |||||||||||||

Name |

|

Salary ($) (1) |

|

Stock Awards ($) |

| Non-Equity Incentive Plan Compensation ($) |

| Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) |

|

All Other Compensation ($) |

|

|

Total Compensation ($) |

Ross H. Parr Senior Vice President - Legal Affairs, General Counsel and Secretary | 501,037 | 726,672 | 2,965,998 | — | 44,467 |

| 4,238,174 | ||||||

Cecil E. Overbey, Jr. Senior Vice President - Strategic Development

|

| 501,037 |

| 726,672 |

| 2,965,998 |

| 10,319 |

| 41,935 |

| 4,245,961 | |

Greg C. Gantt Former President and Chief Executive Officer |

| 499,772 |

| 5,762,385 |

| 4,656,450 |

| 52,985 |

| 325,154 |

| 11,296,746 | |

(1) The base salaries reported in this table and corresponding amounts reflected in the “Compensation Discussion and Analysis” section may differ due to the timing of effective dates for base salary changes.

| |||||||||||||

Approval of an Amendment to our Amended and Restated Articles of Incorporation to Increase the Number of Authorized Shares of our Common Stock To provide us with the flexibility necessary to respond to future needs and opportunities, we are asking our shareholders to approve an amendment to our Amended and Restated Articles of Incorporation to increase the number of authorized shares of our common stock.

| |||||||||||||

Ratification of the Appointment of our Independent Registered Public Accounting Firm As a matter of good corporate governance, we are asking our shareholders to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2024.

| |||||||||||||

Shareholder Proposal Regarding Greenhouse Gas Reduction Targets We recommend that shareholders vote against the shareholder proposal regarding greenhouse gas reduction targets.

| |||||||||||||

2025 Annual Meeting • Shareholder proposals submitted pursuant to Securities and Exchange Commission ("SEC") Rule 14a-8 must be received by us by December 16, 2024. • Notice of shareholder proposals outside of SEC Rule 14a-8, including director nominations pursuant to the proxy access provisions of our bylaws and pursuant to SEC Rule 14a-19, must be received by us no earlier than November 16, 2024 and no later than December 16, 2024. | |||||||||||||

Fiscal 2021 Compensation Decisions (continued)

•With respect to Mr. Gantt, the Compensation Committee approved an increase in his base salary to $920,000, to better align his base salary with competitive market levels for chief executive officers in our peer group.

We believe these compensation program changes further enhance the pay-for-performance focus of our executive compensation program, which underwent a significant redesign beginning in 2019 in response to shareholder feedback, and continue to strengthen the alignment of our executive compensation program with the long-term interests of our shareholders.

| |||||||||||||||||

Fiscal 2021 Compensation Summary | |||||||||||||||||

The following table summarizes the compensation of our Chief Executive Officer, our Chief Financial Officer, and our next three most highly compensated executive officers who were serving at December 31, 2021, to whom we refer to collectively as our named executive officers, for the fiscal year ended December 31, 2021. | |||||||||||||||||

Name |

| Salary ($) |

| Stock Awards ($) |

| Non-Equity Incentive Plan Compensation ($) (1) |

| Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) |

| All Other Compensation($) |

| Total Compensation ($) | |||||

David S. Congdon Executive Chairman of the Board

|

| 641,284 |

| 1,385,540 |

| 6,391,150 |

| 21,235 |

| 148,610 |

| 8,587,819 | |||||

Greg C. Gantt President and Chief Executive Officer

|

| 774,023 |

| 1,975,247 |

| 7,744,570 |

| 46,780 |

| 37,213 |

| 10,577,833 | |||||

Adam N. Satterfield Senior Vice President – Finance, Chief Financial Officer and Assistant Secretary |

| 493,042 |

| 1,257,950 |

| 3,471,056 |

| — |

| 37,261 |

| 5,259,309 | |||||

-6-

-5-

Fiscal 2021 Compensation Summary (continued) | |||||||||||||

Name |

| Salary ($) |

| Stock Awards ($) |

|

Non-Equity Incentive Plan Compensation ($) (1) |

| Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) |

| All Other Compensation ($) |

|

Total Compensation ($) | |

Kevin M. Freeman Executive Vice President and Chief Operating Officer

|

| 583,168

|

| 1,488,187 |

| 4,165,267 |

| 4,601 |

| 25,546 | 6,266,769 | ||

|

| ||||||||||||

Gregory B. Plemmons Senior Vice President – Sales |

| 478,432 |

| 816,548 |

| 2,499,160 |

| 1,046 |

| 24,665

| 3,819,851 | ||

|

| ||||||||||||

(1) The Non-Equity Incentive Plan Compensation payouts for Mr. Congdon and Mr. Gantt reflect reductions of approximately 10% and 7%, respectively, due to the PIP limit of 10x each executive’s base salary. | |||||||||||||

Ratification of the Appointment of our Independent Registered Public Accounting Firm

As a matter of good corporate governance, we are asking our shareholders to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2022. | |||||||||||||

2023 Annual Meeting

• Shareholder proposals submitted pursuant to Securities and Exchange Commission ("SEC") Rule 14a-8 must be received by us by December 19, 2022.

• Notice of shareholder proposals outside of SEC Rule 14a-8, including director nominations pursuant to the proxy access provisions of our bylaws, must be received by us no earlier than November 19, 2022 and no later than December 19, 2022.

|

| ||||||||||||

-6-

The accompanying proxy is solicited by and on behalf of our Board, and the entire cost of such solicitation will be borne by us. This solicitation is being made by mail and may also be made in person or by fax, telephone, or Internet by our officers or employees. In addition, arrangements will be made with brokerage houses and other custodians, nominees and fiduciaries to send proxy materials to their principals, and we will reimburse them for their reasonable expenses in connection therewith.

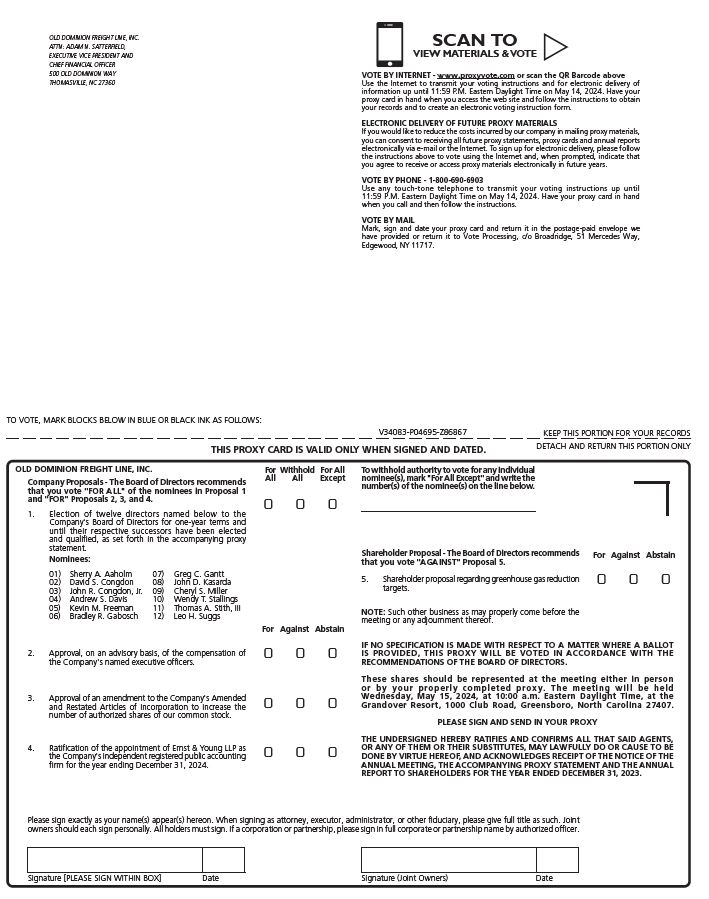

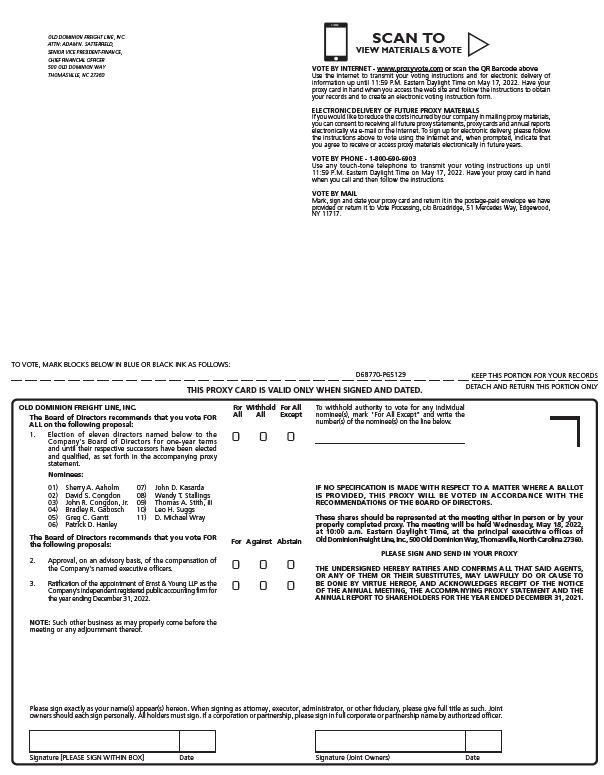

The accompanying proxy is for use at the 20222024 Annual Meeting of Shareholders (the “Annual Meeting”) if a shareholder either will be unable to attend in person or will attend but wishes to vote by proxy. “Registered holders” who have shares registered in the owner's name through our transfer agent may vote by either: (i) completing the enclosed proxy card and mailing it in the postage-paid envelope provided; (ii) voting over the Internet by accessing the website identified on the proxy card and following the online instructions; or (iii) calling the toll-free telephone number identified on the proxy card. Proxies submitted via the Internet or by telephone must be received by 11:59 p.m. Eastern Daylight Time on Tuesday, May 17, 2022.14, 2024.

For shares held in “street name,” that is, shares held in the name of a brokerage firm, bank or other nominee, you should receive a voting instruction form from that institution in lieu of a proxy card. The voting instruction form should indicate whether the institution has a process for beneficial holdersprovides information on how you may instruct your brokerage firm, bank or other nominee to vote overyour shares.

If you own shares through the Old Dominion 401(K) Retirement Plan, you can direct the plan trustee to vote the shares held in your account in accordance with your instructions by completing any proxy card or voting instruction form you receive in the mail and returning it in the envelope provided or by registering your instructions via the Internet or telephone as directed on the proxy card. If you register your voting instructions by telephone. Many banks and brokerage firms participatetelephone or on the Internet, you do not have to mail in the online program offeredproxy card. In order to instruct the plan trustee on the voting of shares held in your account, your instructions must be received by Broadridge Financial Solutions, Inc. This program provides eligible shareholders who receive a paper copy of the proxy statement the opportunity to vote over the Internet or by telephone. The Broadridge Internet and telephone voting facilities will close at 11:59 p.m. Eastern Daylight Time on Tuesday,Monday, May 17, 2022. The Broadridge Internet and telephone13, 2024. If your voting proceduresinstructions are designed to authenticatenot received by that date, the shareholder's identity and to allow shareholders toplan trustee will vote theiryour shares and confirm that theirin the same proportion as the plan shares for which voting instructions have been properly recorded. If the voting instruction form does not reference Internet or telephone information, or if the shareholder prefers to vote by mail, please complete and return the paper voting instruction form in accordance with the instructions provided to you.received.

If you decide to attend the meeting in person, upon your arrival you will need to register with our receptionist in the main lobby of our principal executive offices at 500 Old Dominion Way, Thomasville, North Carolina 27360.representatives at the Grandview Room, which is located on the second floor of the Grandover Resort, 1000 Club Road, Greensboro, NC 27407. Please register at least 15 minutes prior to the start of the Annual Meeting to ensure timely entry to the meeting. Please be sure to have your state- or government-issued photo identification with you at the time of registration. After a determination that you are a registered holdershareholder of Old Dominion common stock as of the record date, you will be allowed to access the meeting room andto attend our Annual Meeting. If you are not a registered shareholder but beneficially own shares of our common stock as of the record date, please be sure that you bring your state- or government-issued photo identification as well as either (i) a proxy issued to you in your name by your brokerage firm, bank or other nominee, or (ii) a brokerage statement showing your beneficial ownership of our common stock as of the record date (and a legal proxy from your brokerage firm, bank or other nominee if you wish to vote your shares at the Annual Meeting) to present to us at the time of registration. Please be aware that the meeting may be subject to in-person gathering restrictions. All meeting attendees will be required to comply with applicable health and safety protocols, which may include, but are not limited to, wearing an appropriate face covering at all times and maintaining a distance of six feet from other meeting attendees.

The Board of Directors has fixed March 10, 20227, 2024 as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting. On March 10, 2022,7, 2024, there were 113,761,155108,812,971 outstanding shares of our common stock each entitled to one vote. This amount is not adjusted for the two-for-one stock split because the shares issued in the two-for-one stock split were not outstanding on the record date. The presence in person or by proxy of a majority of the shares of common stock outstanding on the record date constitutes a quorum for purposes of conducting business at the Annual Meeting. Shareholders do not have cumulative voting rights in the election of directors.

Brokers that are members of certain securities exchanges and that hold shares of our common stock in street name on behalf of beneficial owners have authority to vote on certain items when they have not received instructions from beneficial owners. Under the applicable rules governing such brokers, the proposalproposals to ratify the appointment of our independent registered public accounting firm isand amend our articles of incorporation are considered

-7-

a “discretionary” item.items. This means that brokers may vote using their discretion on this proposalthese proposals on behalf of beneficial owners who have not furnished voting instructions. In contrast, certain items are considered “non-discretionary,” and a “broker non-vote” occurs when brokers do not receive voting instructions from beneficial owners with respect to such items because the brokers are not entitled to vote such uninstructed shares. The proposals to elect directors, and approve, on an advisory basis, the compensation of our named executive officers, and approve the shareholder proposal are considered “non-discretionary,” which means that brokers cannot vote your uninstructed shares when they do not receive voting instructions from you.

-7-

Assuming the existence of a quorum at the Annual Meeting, the voting options for each proposal presented in this proxy statement, as well as the vote required to approve each proposal at the Annual Meeting, are as follows:

Proposal 1 - Election of Directors: With respect to this proposal, you may cast your vote “for all,” “withhold all,” or “for all except” with respect to the director nominees. The nominees receiving a plurality of the votes cast will be elected as directors.

Proposal 2 - Approval, on an Advisory Basis, of the Compensation of Our Named Executive Officers: With respect to this proposal (the results of which will not be binding upon Old Dominion or the Board), you may vote “for,” “against,” or “abstain” from voting. For this non-binding vote to be approved by the shareholders, the votes cast “for” this proposal must exceed the votes cast “against” this proposal.

Proposal 3 - Approval of an Amendment to our Amended and Restated Articles of Incorporation to Increase the Number of Authorized Shares of Our Common Stock: With respect to this proposal, you may vote “for,” “against,” or “abstain” from voting. Approval of this proposal requires the affirmative vote of the holders of more than two-thirds of the outstanding shares of our common stock as of the record date.

Proposal 4 - Ratification of the Appointment of Our Independent Registered Public Accounting Firm: With respect to this proposal, you may vote “for,” “against,” or “abstain” from voting. For this proposal to be approved by the shareholders, the votes cast “for” this proposal must exceed the votes cast “against” this proposal.

Proposal 5 - Shareholder Proposal Regarding Greenhouse Gas Reduction Targets: With respect to this proposal, you may vote “for,” “against,” or “abstain” from voting. For this proposal to be approved by the shareholders, the votes cast “for” this proposal must exceed the votes cast “against” this proposal.

Abstentions, shares that are withheld as to voting and broker non-votes (if any) will be counted for determining the existence of a quorum, but will not be counted as a vote cast with respect to any of these proposalsProposals 1, 2, 4 and 5 and, therefore, will have no effect on the outcome of the vote for any of these proposals presented at the Annual Meeting. Because Proposal 3 requires the vote of outstanding shares, as opposed to votes cast, abstentions will have the effect of a negative vote on Proposal 3.

Where a choice is specified on any proxy as to the vote on any matter to come before the Annual Meeting, the proxy will be voted in accordance with such specification. If no specification is made but the proxy is otherwise properly completed, the shares represented thereby will be voted “for” the election of the director nominees named in this proxy statement, “for” the approval, on an advisory basis, of the compensation of our named executive officers, “for” the approval of an amendment to our amended and restated articles of incorporation, “for” the ratification of the appointment of our independent registered public accounting firm.firm, and “against” the shareholder proposal. Any shareholder submitting the accompanying proxy has the right to revoke it by notifying our Corporate Secretary in writing at any time prior to the voting of the proxy. A proxy is suspended if the person giving the proxy properly elects to vote in person and attends the Annual Meeting.

Management is not aware of any matters, other than those specified above, that will be presented for action at the Annual Meeting. If any other matters do properly come before the Annual Meeting, the persons named as agents in the proxy will vote upon such matters in accordance with their best judgment.

-8-

-8-

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

The following table sets forth information with respect to the beneficial ownership of our common stock, $0.10 par value, our only class of voting security, as of March 10, 2022,7, 2024, or such other date as indicated in the footnotes to the table, for: (i) each person known by us to own beneficially more than five percent of our common stock; (ii) each director;current director and the new non-employee director nominee; (iii) each named executive officer and each of the other executive officers; and (iv) all current directors, the new non-employee director nominee, the named executive officers and all of the other executive officers as a group. Beneficial ownership is determined in accordance with the rules of the SEC. Unless otherwise indicated, the address of all listed shareholders is c/o Old Dominion Freight Line, Inc., 500 Old Dominion Way, Thomasville, NC 27360. As of March 10, 2022,7, 2024, and in compliance with our securities trading policy, none of our directors or executive officers have pledged our common stock.

The number of shares reported for each shareholder in the table and footnotes below, including the number of shares disclosed as having been reported in the Schedule 13G or Schedule 13G/A by each of The Vanguard Group, BlackRock, Inc., and T. Rowe Price Associates, Inc., has been adjusted to reflect the two-for-one stock split.

Name and Address of Beneficial Owner | Shares Beneficially Owned (1) |

Percent | ||||||

The Vanguard Group, Inc. (2) 100 Vanguard Boulevard Malvern, PA 19355 |

21,850,382 |

10.0% | ||||||

BlackRock, Inc. (3) 50 Hudson Yards New York, NY 10001 |

17,603,522 |

8.1% | ||||||

T. Rowe Price Associates, Inc. (4) 100 E. Pratt Street Baltimore, MD 21202 | 12,663,834 | 5.8% | ||||||

David S. Congdon (5) | 11,577,512 | 5.3% | ||||||

John R. Congdon, Jr. (6) | 9,507,286 | 4.4% | ||||||

Greg C. Gantt (7) | 109,528 | * | ||||||

Adam N. Satterfield (8) | 69,030 | * | ||||||

Kevin M. Freeman (9) | 64,432 | * | ||||||

Cecil E. Overbey, Jr. (10) | 46,188 | * | ||||||

Ross H. Parr (11) | 39,560 | * | ||||||

Christopher T. Brooks (12) | 36,974 | * | ||||||

Gregory B. Plemmons (13) | 32,164 | * | ||||||

John D. Kasarda | 13,540 | * | ||||||

Bradley R. Gabosch | 12,588 | * | ||||||

Christopher J. Kelley (14) | 10,488 | * | ||||||

Sherry A. Aaholm | 10,056 | * | ||||||

Steven W. Hartsell (15) | 9,818 | * | ||||||

Leo H. Suggs | 9,588 | * | ||||||

Wendy T. Stallings |

| 5,134 |

|

| * |

| ||

Thomas A. Stith, III |

| 2,684 |

|

| * |

| ||

Andrew S. Davis |

| 952 |

|

| * |

| ||

Cheryl S. Miller |

| — |

|

| * |

| ||

All Directors, the Named Executive Officers and all of the other Executive Officers as a Group (19 persons) | 21,557,522 | 9.9% | ||||||

_______________ | ||||||||

* Less than 1%

Name and Address of Beneficial Owner |

| Shares Beneficially Owned (1) |

|

| Percent |

| ||||

100 Vanguard Boulevard Malvern, PA 19355 |

|

| 10,746,615 |

|

| 9.4% |

| |||

BlackRock, Inc. (3) 55 East 52nd Street New York, NY 10055 |

|

| 10,008,078 |

|

| 8.8% |

| |||

Capital Research Global Investors (4) 333 South Hope Street, 55th Floor Los Angeles, CA 90071 |

|

| 6,511,245 |

|

| 5.7% |

| |||

David S. Congdon (5) |

|

| 6,391,158 |

|

| 5.6% |

| |||

John R. Congdon, Jr. (6) |

|

| 5,073,764 |

|

| 4.5% |

| |||

Greg C. Gantt (7) |

|

| 37,059 |

|

|

| * |

| ||

Adam N. Satterfield (8) |

|

| 28,579 |

|

|

| * |

| ||

Kevin M. Freeman (9) |

|

| 24,659 |

|

|

| * |

| ||

Cecil E. Overbey, Jr. (10) |

|

| 19,793 |

|

|

| * |

| ||

Ross H. Parr (11) |

|

| 16,235 |

|

|

| * |

| ||

Christopher T. Brooks (12) |

|

| 14,940 |

|

|

| * |

| ||

John D. Kasarda |

|

| 13,720 |

|

|

| * |

| ||

David J. Bates (13) |

|

| 13,252 |

|

|

| * |

| ||

Gregory B. Plemmons (14) |

|

| 12,173 |

|

|

| * |

| ||

D. Michael Wray |

|

| 8,984 |

|

|

| * |

| ||

Bradley R. Gabosch |

|

| 7,972 |

|

|

| * |

| ||

Patrick D. Hanley |

|

| 7,972 |

|

|

| * |

| ||

Sherry A. Aaholm |

|

| 4,006 |

|

|

| * |

| ||

Leo H. Suggs |

|

| 3,772 |

|

|

| * |

| ||

Wendy T. Stallings |

| 1,545 |

|

|

| * |

| |||

Thomas A. Stith, III |

| 545 |

|

|

| * | ||||

All Directors, the Named Executive Officers and all of the other Executive Officers as a Group (18 persons) |

| 11,680,128 |

|

|

| 10.3% | ||||

_______________ |

|

|

|

|

|

| ||||

|

|

|

|

|

|

| ||||

|

|

|

|

|

|

| ||||

-9- |

|

|

|

Information was obtained from a Schedule 13G/A filed on January 25, 2024 with the SEC by BlackRock, Inc. (“BlackRock”). BlackRock reported sole power to vote, or direct the vote of, 16,249,732 shares, and sole power to dispose of, or direct the disposition of, 17,603,522 shares. As reported, various persons have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the shares. No one person’s interest in the shares is greater than five percent of the total outstanding common shares. (4) Information was obtained from a Schedule 13G filed on February 14, 2024 with the SEC by T. Rowe Price Associates, Inc. (“T. Rowe”). T. Rowe reported sole power to vote, or direct the vote of, 5,416,358 shares and sole power to dispose of, or direct the disposition of, 12,629,746 shares. (5) Includes: (i) 4,338 shares held directly by David S. Congdon; (ii) 175,316 shares held in Mr. Congdon’s 401(k) retirement plan; (iii) 3,832,042 shares held as trustee of various family trusts; (iv) 3,793,886 shares held through shared voting and investment rights as co-trustee of various family trusts; (v) 3,621,340 shares held through shared voting and investment rights with the shareholder’s spouse as trustee of various family trusts; and (vi) 150,590 shares beneficially owned by certain other family members through various trusts. (6) Includes: (i) 952 shares held directly by John R. Congdon, Jr.; (ii) 3,208,712 shares held as trustee of various family trusts; (iii) 780,514 shares held through shared voting and investment rights as co-trustee of various family trusts; and (iv) 3,797,662 shares held by another trust of the shareholder. This amount also includes 1,719,446 shares held by a GRAT Remainder Trust, with respect to which John R. Congdon, Jr. disclaims beneficial ownership. (7) Includes 15,752 shares owned in Mr. Gantt’s 401(k) retirement plan. (8) Includes 20,950 shares owned in Mr. Satterfield’s 401(k) retirement plan. Excludes 2,038 earned and unvested PBRSUs. (9) Includes 10,142 shares owned in Mr. Freeman’s 401(k) retirement plan. Excludes 2,410 earned and unvested PBRSUs. (10) Includes 8,504 shares owned in Mr. Overbey’s 401(k) retirement plan. Excludes 942 earned and unvested PBRSUs. (11) Includes 616 shares owned in Mr. Parr’s 401(k) retirement plan. Excludes 942 earned and unvested PBRSUs. (12) Includes 838 shares owned in Mr. Brooks’ 401(k) retirement plan. Excludes 942 earned and unvested PBRSUs. (13) Includes 866 shares owned in Mr. Plemmons’ 401(k) retirement plan. Excludes 988 earned and unvested PBRSUs. (14) Includes 4,218 shares owned in Mr. Kelley’s 401(k) retirement plan. (15) Includes 1,120 shares owned in Mr. Hartsell’s 401(k) retirement plan. -10- |

|

-9-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-10-

Proposal 1 - Election of Directors

Our Bylaws currently provide that the number of directors shall be not less than five nor more than twelve. Ourtwelve, and the Board has determined that it shall consist of Directors, upon the recommendation oftwelve directors. The Board, in concert with its Governance and Nomination Committee, has determined thatnominated ten current directors and two new directors – Kevin M. Freeman and Cheryl S. Miller – for election to the Board shall consistat the Annual Meeting. The Board, in concert with its Governance and Nomination Committee: (i) discussed multiple candidates as potential new director nominees as part of eleven directors. its selection process; (ii) sought out highly qualified women and individuals from minority groups to include in the pool from which director nominees were to be chosen; (iii) considered other criteria as set forth in our Corporate Governance Guidelines relating to the recommendation of director nominees; and (iv) obtained input from members of management as appropriate. In recruiting Ms. Miller, the Board paid a fee to a third-party search firm to help identify director prospects, perform candidate outreach, and provide other related services. Following completion of this process and multiple meetings with members of the Board and Old Dominion’s management team, Ms. Miller was formally nominated for election to the Board at the Annual Meeting. Mr. Freeman, who assumed the role of the Company’s President and Chief Executive Officer on July 1, 2023, was formally nominated for election to the Board at the Annual Meeting based on his experience as one of our executive officers and our long-standing practice of having our Chief Executive Officer serve as a member of the Board.

Unless authority is withheld, it is intended that proxies received in response to this solicitation will be voted in favor of the nominees. In accordance with its charter and our Corporate Governance Guidelines, the Board, in concert with its Governance and Nomination Committee, has recommended, and the Board has approved the eleventwelve individuals named below to serve as directors until our next annual meeting and until their respective successors have been elected and qualified or until their death, resignation, removal or disqualification or until there is a decrease in the number of directors. The age and a brief biographical description of each director nominee, his or her position with us, certain board memberships, and the nominee’s specific experience, qualifications, attributes, skills, diversity characteristics or other factors that led our Board to conclude that the candidate is well-qualified to serve as a member of our Board are set forth below. This information and certain information regarding beneficial ownership of securities by such nominees contained in this proxy statement has been furnished to us by the nominees or obtained from filings with the SEC. All of the nominees have consented to serve as directors, if elected.

David S. Congdon (65) (67)was appointed Executive Chairman of the Board effective May 2018, having previously served as Vice Chairman of the Board and Chief Executive Officer from May 2015 to May 2018, and President and Chief Executive Officer from January 2008 to April 2015. He was our President and Chief Operating Officer from May 1997 to December 2007 and served in various positions in operations, maintenance and engineering between 1978 and 1997. He was first elected a director in 1998 and is the cousin of John R. Congdon, Jr., who also serves on the Board. Mr. Congdon, through his more than 40 years of service to us, including 2426 years of service as an executive officer of Old Dominion, has played a critical role in helping us develop our strategic plan and grow our operations through geographic expansion and acquisitions. He has experience leading us through difficult operating conditions and has helped guide Old Dominion to sustained profitability and significant growth in shareholder value. The Board benefits from Mr. Congdon’s critical knowledge of the less-than-truckload (“LTL”) industry, as well ashis leadership in cultivating our unique OD Family Culture, and his deep understanding of the operational and regulatory complexities that we must address as a publicly-traded transportation company.

Sherry A. Aaholm (61)was first elected as a director in 2018. Since April 2021, Ms. Aaholm has served as Vice President and Chief Digital Officer of Cummins, Inc. (NYSE: CMI), a global power leader and a corporation of complementary business segments that design, manufacture, distribute and service a broad portfolio of power solutions, where she previously served as Vice President - Chief Information Officer from June 2013 to March 2021. From August 1999 to December 2012, Ms. Aaholm served as Executive Vice President, Information Technology of FedEx Services. Ms. Aaholm also serves as a member of the board of directors of nVent Electric PLC, a leading global provider of electrical connection and protection solutions. The Board benefits from Ms. Aaholm’s graduate degree in sustainability and her experience as a director of another publicly-traded company, as well as her over 35 years of overseeing mission-critical information systems, extensive experience in technology and information security, and development of digital/Internet of Things (IoT) and prognostics solutions for manufacturing and physical products, including in the transportation and logistics industries. Ms. Aaholm also brings to the Board key human capital management experience, gained from developing successful leadership programs and cultivating talent across different organizations. In addition, the Board benefits from the fact that Ms. Aaholm is National Association of Corporate Directors (“NACD”) Directorship Certified®. NACD Directorship Certified directors establish themselves as committed to continuing education on emerging issues and helping to elevate the role of directorship.

-11-

John R. Congdon, Jr. (67)was first elected as a director in 1998. He is the cousin of David S. Congdon, the Company’s Executive Chairman of the Board. Prior to their acquisition by Penske Truck Leasing in July 2017, Mr. Congdon served as the Chairman of the Board of Directors and Chief Executive Officer for each of Old Dominion Truck Leasing, Inc. and Dominion Dedicated Logistics, Inc. Mr. Congdon has over 40 years of experience in the trucking industry and brings to the Board extensive knowledge of dedicated logistics, fleet management services and the purchase and sale of equipment. Having previously served as chairman of a board, Mr. Congdon also brings experience in board management.

Andrew S. Davis (46)was first elected as a director in 2023. Since April 2022, Mr. Davis has served as Senior Vice President, Strategy and Investments of Cox Enterprises Inc. From December 2019 to February 2022, he served as Director of Private Investments at T. Rowe Price Associates, Inc. (“T. Rowe”), where he managed the private venture capital investments held in portfolios and funds advised by the firm. In a prior role at T. Rowe, from July 2010 to December 2019, Mr. Davis served as Vice President, Equity Investment Analyst, with responsibility for analysis and investment in companies within the transportation sector. Mr. Davis also previously served as a manager in the Financial Advisory Services Group at Deloitte & Touche LLP. Mr. Davis also serves as a member of the board of directors and as chair of the Audit Committee of Wheels Up Experience Inc., a leading provider of on-demand private aviation in the U.S. and one of the largest private aviation companies in the world. The Board benefits from Mr. Davis’ experience in the transportation sector as a public company investor at T. Rowe, his experience as a director of another publicly-traded company and his experience advising on capital allocation and strategic matters in his current and prior roles.

Kevin M. Freeman (65) was nominated by our Board, as further described under “Proposal 1 – Election of Directors.” Mr. Freeman was appointed President and Chief Executive Officer effective July 2023 after serving as our Executive Vice President and Chief Operating Officer since May 2018. He also served as our Senior Vice President – Sales from January 2011 to May 2018 and Vice President of Field Sales from May 1997 to December 2010. Mr. Freeman has 44 years of experience in the transportation industry, and has held various positions in operations and sales with Old Dominion since joining us in February 1992. Mr. Freeman, through his ever-increasing roles and responsibilities with us over the past 32 years, has played a critical role in the development of our operational and sales plans and brings to the Board significant expertise in LTL industry leadership, customer relations and business strategy.

Bradley R. Gabosch (72) was first elected as a director in 2016. Mr. Gabosch previously served as Managing Director for the public accounting firm Grant Thornton LLP from August 2014 to May 2016. Mr. Gabosch also served in various positions at Grant Thornton LLP, including as Carolinas Managing Partner, from October 2009 until his retirement as partner in July 2013. He has over 43 years of experience in the public accounting profession, of which 29 years were spent as an audit partner. Mr. Gabosch brings to the Board extensive knowledge of accounting and management and a strong understanding of financial statement oversight and disclosure matters. The Board also benefits from Mr. Gabosch’s specific public accounting experience in the freight transportation and logistics industry, as well as his expertise in risk management and oversight.

Greg C. Gantt (66) (68)was first elected as a director in 2018. He has served as our President and Chief Executive Officer sincefrom May 2018 to June 2023 and previously served as our President and Chief Operating Officer from May 2015 to May 2018. He was our Executive Vice President and Chief Operating Officer from June 2011 to May 2015, and served as our Senior Vice President - Operations from January 2002 to June 2011. He joined us in November 1994 and was one of our regional Vice Presidents until January 2002. Prior to his employment with us, Mr. Gantt served in many operational capacities with Carolina Freight Carriers Corporation, including Vice President of its Southern Region. Mr. Gantt, through his ever-increasing roles and responsibilities with us over the past 2729 years, has played a critical role in the development of our operational plan andplan. He brings to the Board significant expertise in LTL industry leadership and business strategy.strategy, and valuable experience with respect to marketing, sales and customer relationship management.

Sherry A. Aaholm (59) was first elected as a director in 2018. Since April 2021, Ms. Aaholm has served as Vice President and Chief Digital Officer of Cummins, Inc. (NYSE: CMI), a global power leader and a corporation of complementary business segments that design, manufacture, distribute and service a broad portfolio of power solutions, where she previously served as Vice President - Chief Information Officer from June 2013 to March 2021. From August 1999 to December 2012, Ms. Aaholm served as Executive Vice President, Information Technology of FedEx Services. The Board benefits from Ms. Aaholm’s graduate degree in sustainability as well as her over 33 years of overseeing mission-critical information systems, extensive experience in technology and information security, and development of digital/Internet of Things (IoT) and prognostics solutions for manufacturing and physical products, including in the transportation and logistics industries.

John R. Congdon, Jr. (65) was first elected as a director in 1998. He is the cousin of David S. Congdon, the Company’s Executive Chairman of the Board. Prior to their acquisition by Penske Truck

-11-

Leasing in July 2017, Mr. Congdon served as the Chairman of the Board of Directors and Chief Executive Officer for each of Old Dominion Truck Leasing, Inc. and Dominion Dedicated Logistics, Inc. Mr. Congdon has over 40 years of experience in the trucking industry and brings to the Board extensive knowledge of dedicated logistics, fleet management services and the purchase and sale of equipment. Having previously served as chairman of a board, Mr. Congdon also brings experience in board management.

Bradley R. Gabosch (70) was first elected as a director in 2016. Mr. Gabosch previously served as Managing Director for the public accounting firm Grant Thornton LLP from August 2014 to May 2016. Mr. Gabosch also served in various positions at Grant Thornton LLP, including as Carolinas Managing Partner, from October 2009 until his retirement as partner in July 2013. He has over 43 years of experience in the public accounting profession, of which 29 years were spent as an audit partner. Mr. Gabosch brings to the Board extensive knowledge of accounting and management and a strong understanding of financial statement oversight and disclosure matters.

Patrick D. Hanley (77) was first elected as a director in 2016. Mr. Hanley has an extensive history in the trucking industry having most recently served as Senior Vice President - Finance and Accounting of UPS Freight (formerly Overnite Corporation and now known as TForce Freight, a subsidiary of TFI International) from August 2005 to October 2007. Mr. Hanley also served on the board of directors of Overnite Corporation and as Director, Senior Vice President and Chief Financial Officer of its subsidiary Overnite Transportation from June 1996 to August 2005. Prior to such roles, Mr. Hanley served in various senior financial positions at Union Pacific Resources Group and Union Pacific Corporation. Mr. Hanley has served on the Board of Directors of NewMarket Corporation (NYSE: NEU), which develops, manufactures, blends and delivers chemical additives that enhance the performance of petroleum products, since 2004. Mr. Hanley served as Chairman of the Board of Directors of Gallium Technologies, LLC from January 2011 to January 2016, having previously served as its President and Chief Executive Officer from July 2009 to January 2011. He also served on the Board of Directors for Xenith Bankshares, Inc. from January 2010 to July 2016. Mr. Hanley brings to the Board significant knowledge in the management and oversight of public companies and significant leadership experience in accounting and finance within the trucking industry.

John D. Kasarda, Ph.D. (76)(78) was first elected as a director in 2008. Dr. Kasarda has a Ph.D. in Sociology. He serves as the President and Chief Executive Officer of Aerotropolis Business Concepts LLC and the President of Aerotropolis Institute China. Dr. Kasarda is also serves on the faculty at the University of North Carolina at Chapel Hill's Kenan-Flagler Business School.School and is a former Chair of the University's Department of Sociology. He is considered the leading developer of the aerotropolis concept, which brings together air logistics and surface transportation to foster airport-linked business development. He is the former Editor-in-Chief of Logistics,, an international journal of transportation and supply chain management, and brings a unique perspective and creative insights to our Board due to his breadth of knowledge in business strategy, transportation, logistics, and global supply chain management, combined withsustainable development. Through his thought leadership and worldwide experiences in the transportation industry.industry, he provides our Board with critical perspective and analysis regarding shareholder and stakeholder governance matters.

-12-

Cheryl S. Miller (51) was nominated by our Board, as further described under “Proposal 1 – Election of Directors.” Ms. Miller most recently served as Chief Financial Officer of West Marine, the nation’s leading omni-channel provider of products, services and expertise for the marine aftermarket, from January 2022 to October 2022. She previously served as Executive Strategic Advisor to JM Family Enterprises, a diversified automotive company, from May 2021 to December 2021, prior to which she served as Executive Vice President and Chief Financial Officer of JM Family Enterprises from January 2021 to April 2021. She previously served as President and Chief Executive Officer of AutoNation, Inc., a publicly traded automotive retailer with major metropolitan franchises and e-commerce operations from July 2019 to April 2020, prior to which she served as Executive Vice President and Chief Financial Officer of AutoNation, Inc. since 2014, and as its Treasurer and Vice President of Investor Relations since 2010. Ms. Miller also served on the Board of AutoNation, Inc. from July 2019 to July 2020. She currently serves on the board of directors and as chair of the Compensation and Leadership Development Committee of Tyson Foods, Inc., one of the world’s largest food companies and a recognized leader in protein. She also currently serves on the board of directors and as chair of the Audit Committee of Celsius Holdings, Inc., a global lifestyle fitness drink company. The Board will benefit from Ms. Miller’s more than 20 years of corporate finance experience, financial statement expertise and deep understanding of public company shareholder matters.

Wendy T. Stallings (47)(49) was first elected as a director in 2020. Ms. Stallings is a real estate investor and the sole owner of TPI Event Solutions, Inc., a full-service event management company specializing in large scale national catering contracts, hospitality, corporate events, merchandise and contract fulfillment, where she has served as President and CEO since founding the company in December 2000. She was also the co-owner of Excel Learning Centers, a children’s early learning program, withwhere she acquired and developed campuses located throughout North Carolina where sheand served as Vice President from March 2006 until the sale of the business in August 2021. The Board benefits from Ms. Stallings’ law degree as well as her comprehensive expertise in entrepreneurship, strategic planning, sales, customer relations and business management. Ms. Stallings also brings to the Board significant knowledge with respect to regulatory, reporting, and human relations matters gained from her varied business experiences.

Thomas A. Stith, III (58) (60) was first elected as a director in 2021. Since July 2022 (and from January 2021,2017 to September 2019), Mr. Stith has served as CEO of The Michael Thomas Group, a firm that he co-founded in 1995 focused on consulting and advising clients seeking business development opportunities in the public and private sectors. He also serves as a Professor of the Practice at the University of North Carolina at Chapel Hill's Kenan-Flagler Business School and as a Senior Fellow for the Kenan Institute of Private Enterprise, where he previously served as a 2023 Distinguished Fellow to support the Institute's Grand Challenge: Workforce Disrupted Seeking the Labor Market’s Next Equilibrium initiative. Distinguished Fellows are global scholars committed to leveraging their individual expertise, thought leadership, research and networks to further the institute’s efforts to examine – and drive solutions to – the most complex and timely issues facing business and the economy. From January 2021 to July 2022, Mr. Stith served as President of the North Carolina Community College System, where, as chief administrative officer of the system, he providesprovided policy oversight and guidelines for the 58 community and technical colleges in the system. From September 2019 to December 2020, Mr. Stith served as District Director of the U.S. Small Business Administration (“SBA”), with responsibility, as the SBA’s senior representative in North Carolina, for developing and implementing the District Office Strategic Plan while directing and

-12-

managing all SBA programs within North Carolina. From January 2017 to September 2019, Mr. Stith was the Chief Executive Officer and co-founder of The Michael Thomas Group, a firm focused on consulting and advising clients seeking business development opportunities in the public and private sectors. From January 2013 to December 2016, Mr. Stith served as Chief of Staff to North Carolina Governor Pat McCrory, in which role he advised and made recommendations to the Governor on public policy, budget, and state government operations matters. TheMr. Stith brings to the Board benefits from Mr. Stith’s extensive experience in public policy and administration, diversity and inclusion and legislative affairs.affairs, including valuable expertise with respect to information system management and social and governance matters at the federal, state and local levels. The Board also benefits from the fact that Mr. Stith is NACD Directorship Certified®.

Leo H. Suggs (82)(84) was first elected as a director in 2009 and has served as our Lead Independent Director since December 2018. Mr. Suggs has a long and distinguished career in the trucking industry that began in 1958, holding a wide range of positions that included Chairman and Chief Executive Officer of Overnite Transportation from 1996 to 2005 and President and Chief Executive Officer of UPS Freight from 2005 to 2006. As President and Chief Executive Officer of Overnite Transportation and as a memberChairman of its Board of Directors, from November 2003 to May 2005, Mr. Suggs gained extensive knowledge about managing a union-free motor carrier in the LTL industry. He understands the opportunities and challenges associated with the LTL industry, and has first-hand knowledge of merger and acquisition considerations and strategies. We believe that Mr. Suggs is invaluable to our Board as an adviser on logistics services and LTL operations.

D. Michael Wray (61) was first elected as a director in 2008. Mr. Wray is the President of Riverside Brick & Supply Company, Inc., a distributor of masonry materials in central Virginia. Mr. Wray has served in that position since 1998 and was formerly its Vice President and General Manager from 1996 to 1998. From 1992 to 1995, Mr. Wray was employed by Ruff Hewn, Inc., an apparel designer and manufacturer, where he held positions including Chief Financial Officer and Treasurer. Mr. Wray also served in various audit and management positions with Price Waterhouse from 1982 to 1992. The Board benefits from his experience in public accounting, which includes experience with the transportation industry. In addition, he has extensive knowledge of accounting and a valuable understanding of financial statement oversight and disclosure considerations gained from his experience as a chief financial officer. Mr. Wray also brings company leadership and business management expertise to his service on our Board due to his ongoing responsibilities as President of Riverside Brick & Supply Company, Inc.

The nominees receiving a plurality of the votes cast will be elected as directors.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES IDENTIFIED ABOVE.

The following provides certain information about our executive officers who are not directors or nominees:

David J. Bates (57) was appointed Senior Vice President - Operations in October 2011 after serving as our Vice President - Central States Regionsince July 2007. From March 2002 to July 2007, Mr. Bates served as our service center manager in Harrisburg, Pennsylvania. Mr. Bates has also served in various other positions in operations with Old Dominion since joining us in December 1995.

Christopher T. Brooks (51) (53) was appointed Senior Vice President - Human Resources & Safety effective January 2018 after serving as our Vice President - Human Resources from June 2015 to December 2017. Prior to joining us, he served as Senior Vice President of Human Resources at National General Insurance (which was acquired by The Allstate Corporation in 2021) from January 2015 to June 2015 after serving as that company’s Vice President of Human Resources from January 2010 to December 2014.

Kevin M. Freeman (63)Steven W. Hartsell (56) was appointed ExecutiveSenior Vice President and Chief Operating Officer– Sales effective May 2018July 2023, after serving as our Vice President – Field Sales since January 2019. Mr. Hartsell also served as our Director – Expedited Sales & Service from May 2008 to January 2019 and as one of our Regional Sales Directors from March 2002 to May 2008. Mr. Hartsell previously served in various other positions in operations and sales since joining us in January 1998.

Christopher J. Kelley (54) was appointed Senior Vice President - Sales from January 2011 to– Operations effective May 2018

-13-

and2023, after serving as our Vice President – Central States Region since November 2011. He also served as one of Fieldour Regional Sales Directors from May 1997November 2004 to December 2010.November 2011. Mr. FreemanKelley has 4232 years of experience in the transportation industry, and has heldserved Old Dominion in various other positions in sales with Old Dominion since joining us in February 1992.July 2002.

Cecil E. Overbey, Jr. (60)(62) was appointed Senior Vice President - Strategic Development in January 2011 after serving as our Vice President of National Accounts and Marketing since July 2000. Mr. Overbey has 3638 years of experience in the transportation and distribution industries, and since joining us in June 1995 as a National Account Executive, has held various other management positions in sales and marketing with Old Dominion.

Ross H. Parr (50)(52) was appointed Senior Vice President - Legal Affairs, General Counsel and Secretary effective January 2016, after serving as our Vice President - Legal Affairs, General Counsel and Secretary since May 2012. Mr. Parr joined us in August 2011 and served as our Vice President, Deputy General Counsel and Assistant Secretary until May 2012. From August 2003 to December 2007 Mr. Parr was an associate, and from January 2008 to August 2011 he was a member, at the law firm Womble Carlyle Sandridge & Rice (now known as Womble Bond Dickinson (US) LLP).

Gregory B. Plemmons (57)(59) was appointed Executive Vice President and Chief Operating Officer effective July 2023 after serving as our Senior Vice President – Sales effectivesince January 2019, after serving2019. He also served as our Vice President – Field Sales sincefrom September 2013. He also served2013 to January 2019 and as our Vice President – OD Global from December 2002 to September 2013. Mr. Plemmons has 3335 years of experience in the transportation industry, and has served Old Dominion in various other positions in operations and sales since joining us in April 1997.

Adam N. Satterfield (47)(49) was appointed Executive Vice President, Chief Financial Officer and Assistant Secretary effective July 2023, after serving as Senior Vice President - Finance, Chief Financial Officer and Assistant Secretary effectivesince January 2016, after serving2016. Mr. Satterfield also served as our Vice President -– Treasurer sincefrom June 2011. Mr. Satterfield also served2011 to December 2015, as our Director - Finance and Accounting from August 2007 to June 2011 and as our Manager - SEC Reporting from October 2004 to August 2007. Prior to joining us in October 2004, he was an Audit Manager with KPMG LLP, a global accounting firm. Mr. Satterfield is a Certified Public Accountant.

Historically, ourSince January 2008, the Board has separated the roles of Chairman of the Board has alsoand Chief Executive Officer. The separation of the roles allows the Company to leverage the extensive knowledge of a former Chief Executive Officer of the Company. Earl E. Congdon served as our Chairman and Chief Executive Officer from 1985 through 2007, Executive Chairman from January 2008 to April 2018, and Senior Executive Chairman from May 2018 to January 2021. David S. Congdon, who currently serves as our Executive Chairman, served as our Chief Executive Officer from January 2008 to May 2018. The Company and these dual roles were held for many years by Earl E. Congdon, who now serves as Chairman Emeritus and Senior Advisor to the Company. In 2007, however, following Earl E. Congdon's decision to resignBoard benefit from the significant expertise and experience of a prior Chief Executive Officer position effective on January 1, 2008, the Board determined that it was in the best interestsChairman role, while providing full oversight of our shareholdersstrategic initiatives and business plans to appoint David S. Congdon, who had been serving as our President and Chief Operating Officer, as ourthe current Chief Executive Officer and to redesignate Earl E. Congdon as Executive Chairman of the Board. The Board took these actions because it wanted to preserve the ability of a former Chief Executive Officer to continue to have a significant executive role on our management team. This objective was further maintained with the transitions of David S. Congdon to Executive Chairman and Earl E. Congdon to Senior Executive Chairman as part of the Board’s designed succession plan effective May 2018. Earl E. Congdon retired from our Board effective January 1, 2021 and ceased to serve as Senior Executive Chairman on such date.Officer.

The Board also believes that strong, independent Board leadership is an important aspect of effective corporate governance and, as a result, appointed a Lead Independent Director in January 2010. Leo H. Suggs has served in such

-14-

role since December 2018. Our Lead Independent Director's responsibilities and authority include presiding at meetings of our independent directors, coordinating with our Executive Chairman and our Chief Executive Officer on Board meeting agendas, schedules and materials and otherwise acting as a liaison between the independent directors, our Executive Chairman and our Chief Executive Officer. For these reasons, the Board believes that this leadership structure is appropriate for us. The Board believes that there is no specific generally accepted leadership structure that applies to all companies, nor is there one specific leadership structure that permanently suits us. As a

-14-

result, our decision as to whether to combine, separate or add to the positions of Chairman and Chief Executive Officer and whether to have a Lead Independent Director may vary from time to time, as industry or our own conditions and circumstances warrant. The independent directors of the Board consider the Board's leadership structure on an annual basis to determine the structure that is most appropriate for the governance of Old Dominion.

In accordance with the listing standards of The Nasdaq Stock Market, LLC (“Nasdaq”), our Board must consist of a majority of independent directors. The Board upon the recommendation of the Governance and Nomination Committee, has determined that current directors Ms. Aaholm, Mr. Gabosch,Davis, Mr. Hanley,Gabosch, Dr. Kasarda, Ms. Stallings, Mr. Stith, Mr. Suggs, and Mr. Wraynew director nominee Ms. Miller, are each independent in accordance with Nasdaq listing standards. The Board performed a review to determine the independence of its members and made a subjective determination as to each that no transactions, relationships or arrangements exist that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director of Old Dominion. In making these determinations, the Board considered information provided by the current directors as well as Ms. Miller, in addition to information obtained by us, with regard to each individual's business and personal activities as they may relate to us and our management. Our Corporate Governance Guidelines direct the independent directors of the Board to meet in executive session at least twice each year, and they met four times in 2021.2023. Shareholders may communicate with the independent directors by following the procedures set forth in “Shareholder Communications with the Board” in this proxy statement.

Attendance and Committees of the Board

Pursuant to our Corporate Governance Guidelines, directors are expected to attend the Annual Meeting and all meetings of the Board, including all meetings of Board committees of which they are members. All of our directors then in office were present at our 20212023 Annual Meeting of Shareholders that was held on May 19, 2021.17, 2023. Our Board of Directors held seven meetings during 2021.2023. The Board of Directors has threefour standing committees: the Audit Committee, the Compensation Committee, and the Governance and Nomination Committee and the Risk Committee. Each member of the Audit Committee, the Compensation Committee, and the Governance and Nomination Committee and the Risk Committee is an “independent director” as such term is defined under applicable SEC rules and regulations and Nasdaq listing standards. In 2021,2023, all of ourincumbent directors attended at least 75% of the aggregate meetings held by the Board and their assigned committees during the period for which they served on the Board or such committees.

Audit Committee

The Audit Committee, which is a separately-designated standing Audit Committee established in accordance with section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), currently consists of D. Michael Wray (Chair), Sherry A. Aaholm (Chair), Andrew S. Davis, and Bradley R. Gabosch, and Patrick D. Hanley, each of whom the Board has determined is independent pursuant to applicable SEC rules and regulations and Nasdaq listing standards. The Board has determined that all Audit Committee members are financially literate and that Mr. Gabosch, Mr. HanleyDavis and Mr. WrayGabosch each qualify as an “audit committee financial expert” as defined by applicable SEC rules. Please refer to the experience described for each of these members under “Proposal 1 - Election of Directors” in this proxy statement.

The Audit Committee is governed by a written charter approved by the Board, which is available on our website at https://ir.odfl.com/governance-docs.corporate-governance/governance-documents. The Committee annually reviews this charter to reassess its adequacy and recommends any proposed changes to the Board for approval. Committee members are nominated annually by the Governance and Nomination Committee and approved by our Board to serve for one-year terms. Information regarding the functions performed by this committee is set forth in the “Report of Audit Committee,” which is included in this proxy statement. In fulfilling its duties, the Audit Committee, among other things, appoints, compensates and oversees the work of the independent registered public accounting firm. In addition, our Risk Management and Compliance Departments report to the Audit Committee onperiodically meets with management to review the assessmentresults of risk assessments, including our major financial risk exposures and mitigation of key risksteps management has taken to monitor and compliance

-15-

matters across our business, ourcontrol such exposures. Our Internal Audit Department reports to the Audit Committee on its audit plan and our audit-related processes and procedures and internal controls, and our OD Technology Department reports to the Audit Committee on our cybersecurity, technology and data privacy initiatives.controls. The Audit Committee met eleventen times in 2021.2023. The Audit Committee holds telephonic meetings after each quarterly period to

-15-

discuss with both management and our independent registered public accounting firm, Ernst & Young LLP (“EY”), the financial results to be included in our periodic filings with the SEC prior to their release.

Compensation Committee

Our Compensation Committee currently consists of Leo H. Suggs (Chair), PatrickJohn D. Hanley,Kasarda and Wendy T. Stallings, and D. Michael Wray, each of whom the Board has determined to be independent pursuant to applicable SEC rules and regulations and Nasdaq listing standards. Committee members are nominated annually by the Governance and Nomination Committee and approved by our Board to serve for one-year terms.